This tutorial shows how pine script can be used to trade with Bracket Orders using chart based on stop loss and target. We use the below premise to take Buy/Sell trades with chart based stop loss and target via Bracket Order.

Strategy Premise

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Increasing RSI shows increasing bullish momentum. Decreasing RSI shows increasing bearish momentum. We take RSI upper bound as 80 to indicate bullish momentum and RSI lower bound as 20 to indicate bearish momentum.

Strategy Logic

Long Entry: When RSI goes above 80, trigger LE with Buy Bracket Order. SL and TGT will be based on user input via parameters.

Short Entry: When RSI goes below 20, trigger Sell Bracket Order. SL and TGT based on user input via parameters.

There is no need for Long Exit and Short Exit for Bracket Orders. In case you want to modify BO manually, you can do from broker’s terminal. See here for more details for BO/CO based trading.

TradingView Settings for Bracket Order Pine script Strategy

Download the strategy file here

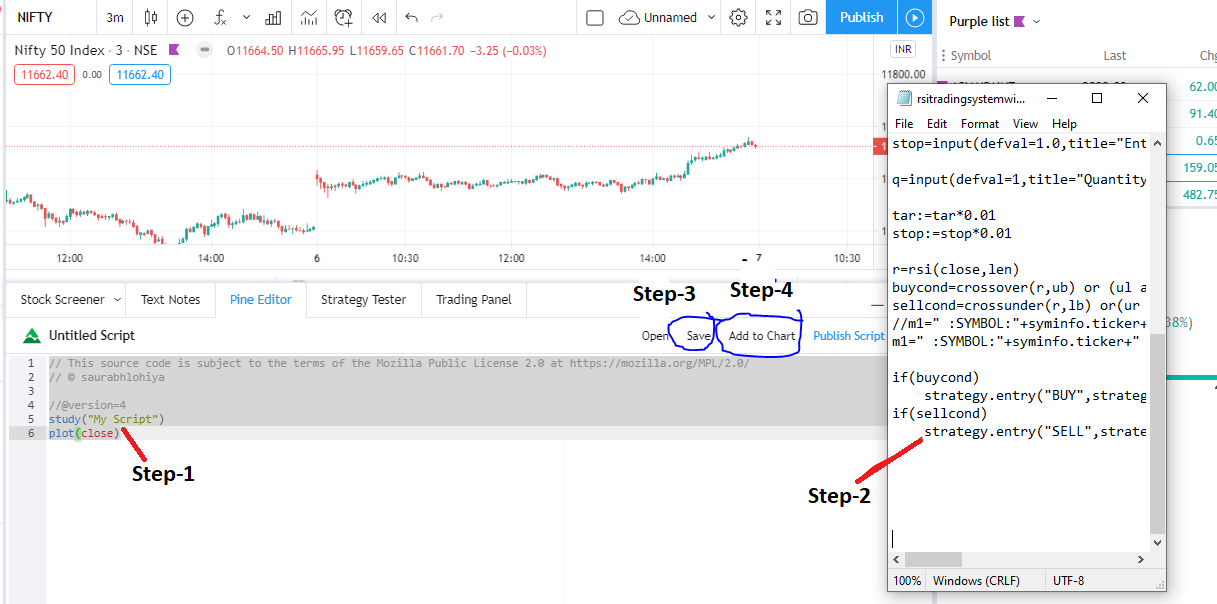

Open desired chart in trading view with normal candlestick ,select desired time frame of the chart. Next, follow these steps: (1) Go to pine editor section, remove the default code, (2) paste the downloaded code, (3) save the file and (4) add to chart. See screenshot below.

RSI Bracket Order Strategy Parameters for TradingView Charts

- Relative Strength Index Length(Mandatory): This is number of bars used to calculated RSI Ex: 14 a previous 14 candles are used to calculate RSI

- Upper Band (Mandatory): This is used to specify upper band of RSI

- Lower Band (Mandatory): This is used to specify lower band of RSI

- Use reversal from Upper Band (Optional): This will enable short entry when RSI is falling bellow 80 from upper band

- Use reversal from Lower Band (Optional) : This will enable long entry when RSI is raising above 40 from lower band. Quantity: Used to specify the trade quantity (for Nifty min 75)

- Custom Stop Loss in Points: Movement in chart price against the momentum which will trigger exit in options positions

- Custom Target in Points: Movement in chart price against the momentum which will trigger exit in options positions

Setting Up Alert

Before setting up alert make sure that You have selected desired script, time frame,strategy settings, APIbridge is configured and running. Click in settings add alert and paste {{strategy.order.comment}} in message box.

Important: Do not change any settings during live trading. It may break the sequence of exit by previous SL/TGT.

NOTE: The pine script works both with Webhook alerts (TV Pro plan) and normal popup alerts (TV free plan).

APIBridge Settings

This is an advanced strategy. You are first requested to complete TradingView Jump Start Setup. Make sure you use the latest extension v4.1 for this strategy.

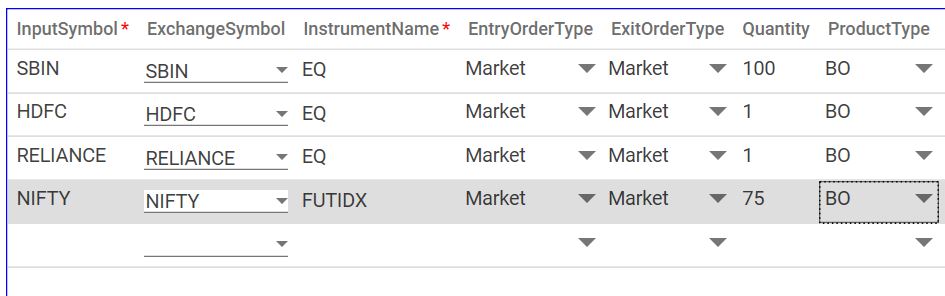

Since we send quantity in alerts there would be no need to specify quantity in APIBridge Symbol Settings but make sure that you set order type to BO.

Pinsecript Coding Guide

In extension v4.1 and Webhooks, you can use full power of APIBridge signals as per given format here in Example 5. To send SL and TGT, use in alert OT:Market|BO and TRIG: 302|1.5|3

Recent Discussion