This tutorial shows how Range Breakout AFL Strategy can be used on charts of Amibroker to Trade in Index Options.

Strategy Premise

This Range Breakout strategy uses only price action and no indicators. The range for the last n periods calculates by taking the highest high and lowest low value of the last n periods. This range namedDonchian Channels.

Such a trading strategy suggested by trader Richard Donchian. Richard suggested using the strategy on the daily timeframe for a range of the last 20 days. In our testing on the 15-minute time frame, we use the 50-period window to avoid false signals.

These also called volatility bands because the expanding/contracting channels indicate the market volatility. The trading rules for this strategy are similar to the ATR Bands Strategy and Bollinger Bands Strategy.

Strategy Logic:

Buy Entry: When price cross above the 50 period range

Sell Entry: When prices cross below the 50 period range

That is to say, when Strategy gives Buy, it will send LE in Call and LX in Put.

On the other hand, when Strategy gives Sell, it will send LE in Put and LX in Call.

Amibroker AFL Settings

To start Algo trading with Range Breakout AFL on Amibroker to trade in options, simply follow the steps given below.

1: Make sure you have completed Jump Start setup

2: Download AFL from here. In Amibroker, Go to Formula editor and paste the AFL here.

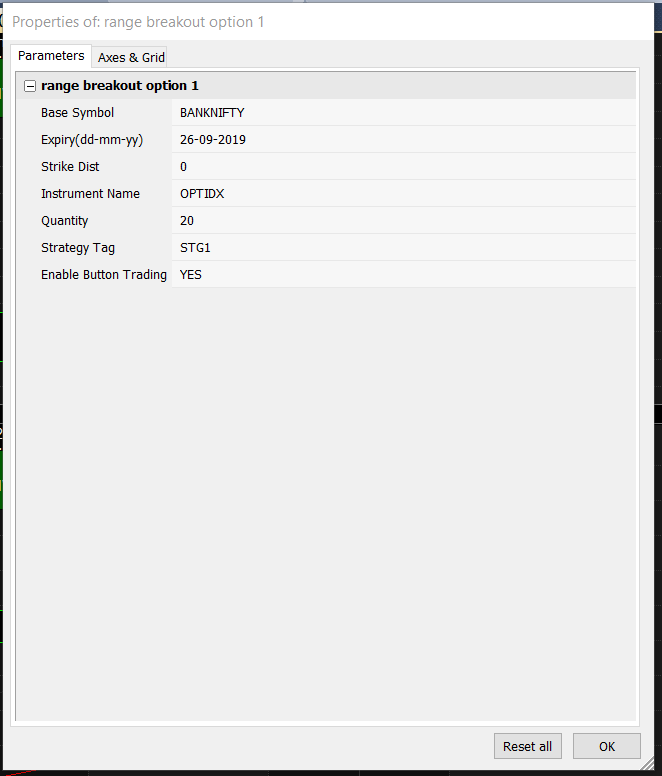

3: Right Click on the chart and go Parameters to adjust the inputs of the strategy.

This lesson demonstrated how to implement the Range Breakout AFL Strategy on the Amibroker software to trade Index Options.

Recent Discussion