Reference: Do I need Free or Paid version in TradingView?

You can automate complete strategies, and not just indicators using the TradingView free version. That’s right! explore 1000s of strategies from public library using free Tradingview and free APIBridge (paper trading). We will demonstrate this using SuperTrend strategy (not SuperTrend indicator).

Strategy Premise

The SuperTrend indicator is calculated utilizing the ATR to offset the indicator from the common price. When the price touches the SuperTrend collection it turns to the other direction.

Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price MACD is calculated by subtracting the long-term EMA (26 periods) from the short-term EMA (12 periods) The MACD has a positive value whenever the 12-period EMA is above the 26-period EMA and a negative value when the 12-period EMA is below the 26-period EMA.

This strategy is a combination of Supertrend and MACD. When MACD is in buy, and Supertrend also indicates a Buy, we get into a long position and vice-versa.

Strategy Logic

Long Entry: When 12 Period EMA is above the 26- Period EMA and Supertrend turns green, Send LE

Long Exit: Either when SL or Target is hit. If SL/TGT is not hit and 12-period EMA is below the 26-period EMA and Supertrend turns red. Send LX, SE

Short Entry: When 12-period EMA is below the 26-period EMA and Supertrend turns red, Send SE

Short Exit: Either when SL or Target is hit. If SL/TGT is not hit and 12 Period EMA is above the 26- Period EMA and Supertrend turn green. Send SX, LE

Note: Please add MACD indicator for reference of MACD rules.

The TradingView free plan allows to run max 2 alerts at same time, which are sufficient to automate one strategy. To demonstrate, we will pick the “Super Trend 2 MACD” strategy from public library. This strategy uses both ST and MACD.

TradingView Settings

STEP 1: Download The Pine Script Algo here.

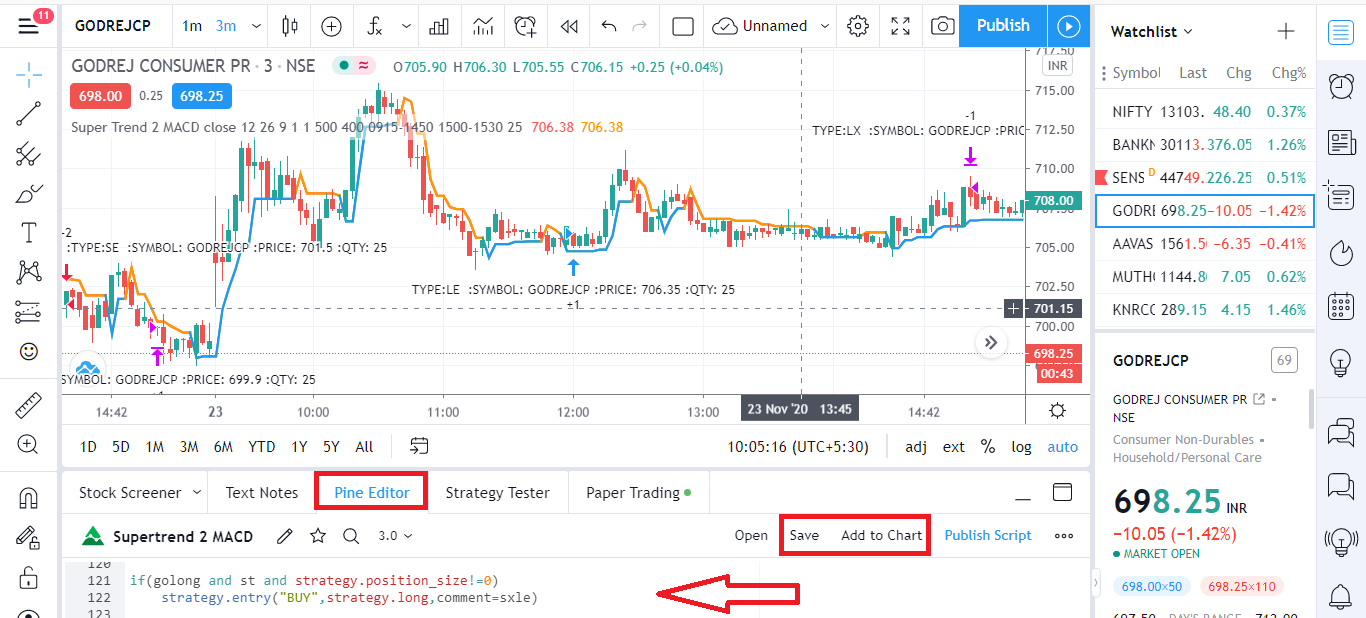

STEP 2: Open desired Chart in trading View with normal Candlestick, Select the desired timeframe of the chart, Go to the pine editor section, remove the default code, paste the downloaded code, save the file, and to chart.

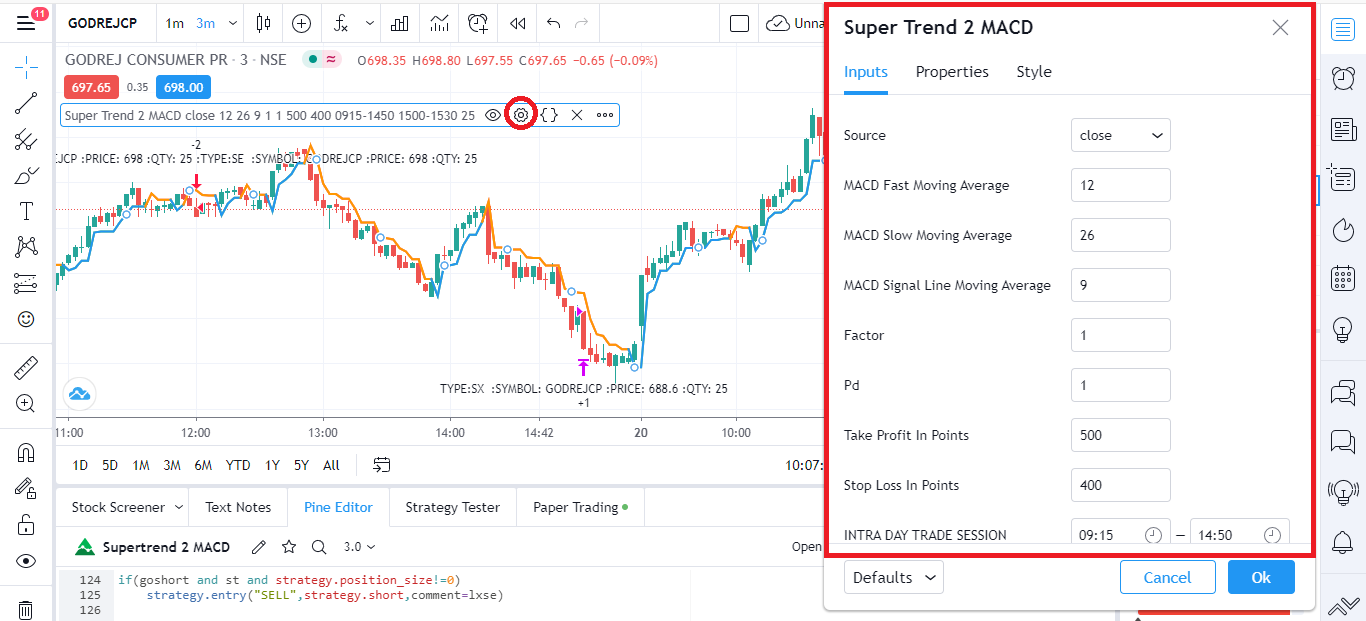

STEP 3: Once Strategy is applied to the chart, click on settings to optimize parameters for your own trading.

Setting Up Alert

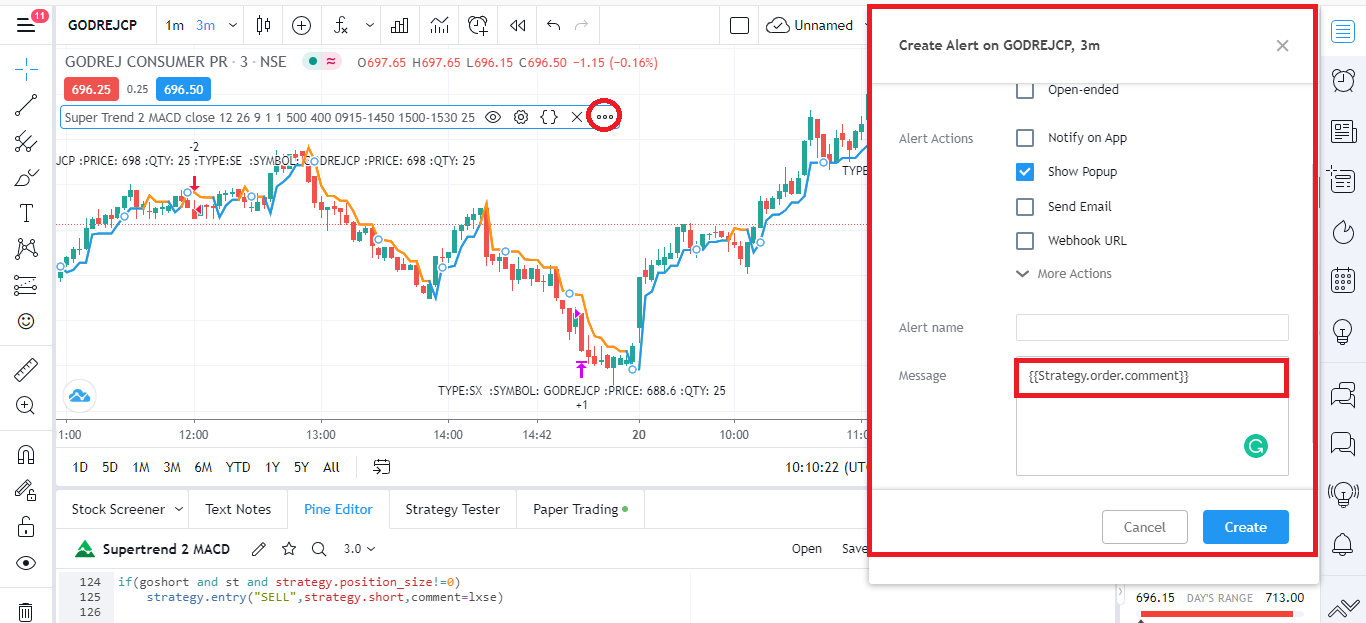

Before setting up an alert make sure that You have selected the desired script, timeframe, strategy settings, API bridge is configured and running. Click in settings add alert and paste {{strategy.order.comment}} in message box.

Important: do not change any settings during live trading.

NOTE: The pinescript works both with webhook alerts (TV Pro plan) and normal popup alerts (TV free plan).

Do you want coding help to deploy your own strategy for live trading? Check our coding assistance.

when i add your code below in the pine editor .. its not showing alerts?

when i add your code below in the pine editor .. its not showing alerts

same massage i get i am useing free version

plz reply

Download script not available